Employers are not hiring at the moment. This doesn’t mean double dip that some economists are talking about, however. A pause in activity is normal during economic recoveries, as Alan Greenspan and others have commented recently.

Initial weekly claims for unemployment that track those applying for unemployment insurance is the best indicator of present job conditions. It has remained stagnant since January, though claims have been rising of late.

Initial claims for unemployment insurance are piling up, indicating that businesses are continuing to cut costs. Initial claims came in at 500,000 in the August 14 week for the largest total since November. The four-week average of 482,500 is the largest since December. A month-to-month look shows significant deterioration of 25,000 for a percentage change of nearly six percent.

But this is in part because all those Census workers the government hired have finished their work. And continuing claims continue down—13,000 in data for the August 7 week. The four-week average of 4.527 million is the lowest of the recovery.

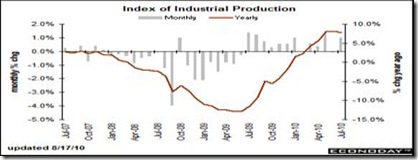

July’s industrial production report was also positive. Manufacturing - which has been a key source of strength for the recovery but faltered in June – showed significant resurgence in July. Overall industrial production in July jumped 1.0 percent, following a revised 0.1 percent down tick in June.

By components, manufacturing posted a 1.1 percent comeback, following a 0.5 percent decline in June. The boost was broad-based as manufacturing excluding motor vehicles increased 0.6 percent, following a 0.3 percent dip the month before. Rounding out industry group components for July, utilities output was up 0.1 percent while mining advanced 0.9 percent.

And so-called capacity utilization jumped to 74.8 percent in July from 74.1 percent the prior month. This is still far below the long term 82 percent capacity utilization average, indicating lots of excess facilities, which is why companies are not investing in new plants—and so doing much hiring.

Lastly, retail sales are still slightly positive. What are now being called ‘cautious’, and ‘discriminating’ shoppers have been saving while spending for the near term only.

Overall retail sales in July rebounded 0.4 percent, following a 0.3 percent decrease in June. A large part of the strength came from the auto component. Excluding autos, sales gained 0.2 percent, following a 0.1 percent downtick in June. The boost in auto sales is a positive, as is the other source of strength - a spike in gasoline sales likely lifted by higher prices.

Without the jump in gasoline sales, consumer spending was soft. But higher gas sales means consumers are driving more, a good sign. Sales excluding autos and gasoline slipped 0.1 percent, following a 0.2 percent boost in June. By components, the rebound in July was led by a 1.6 percent boost in motor vehicle sales and a 2.3 percent jump in gasoline station sales. Also showing gains were miscellaneous stores, nonstore retailers, and food services & drinking places.

Need we say more? None of the indicators show a real decline in demand, rather a pause as both consumers and employers remain cautious about future economic activity, and the jobs outlook.

Harlan Green © 2010

No comments:

Post a Comment