In a bid to stimulate banks to lend more by increasing their reserves, the Federal Reserve announced QE2 (Quantitative Easing 2). It will be buying up to $600 billion in Treasury securities from banks who hold them. We have no doubt this will kick start economic growth for several reasons. Not least, because there are signs of an additional pickup in both investment and hiring among small businesses.

In a New York Times’ column by Gretchen Morgenson, Ian Shepherdson of High Frequency Economics—noted for predicting the housing bust—sees growth increasing in the small business sector that creates the most jobs, because of a pickup in commercial and industrial bank lending.

And as commercial and industrial lending expands, Shepherdson maintains, it will unleash a pent-up demand among smaller companies for capital equipment, software, vehicles and other goods:

“The depression in small business pretty much explains everything in the weakness of this cycle,” he said. “I reckon in the last cycle they accounted for two-thirds of all new job creation. Not only are they big, they are better job-creation engines than big companies, which are more inclined to do their new hiring offshore.”

The deficit hawks maintain this will stimulate inflation down the road, because it puts too much money in circulation. But in fact buying back securities that banks have purchased from the U.S. Treasury doesn’t directly put money in the pockets of the consumers who spend it. It builds up banks’ cash reserves, which enables them to lend to small, as well as large businesses, as we have said.

Fed Chairman Bernanke downplayed the inflation danger in a recent Washington Post Op-ed: “Our earlier use of this policy approach (QE1) had little effect on the amount of currency in circulation or on other broad measures of the money supply, such as bank deposits. Nor did it result in higher inflation. We have made all necessary preparations, and we are confident that we have the tools to unwind these policies at the appropriate time. The Fed is committed to both parts of its dual mandate and will take all measures necessary to keep inflation low and stable, he said.”

The big news was that October private nonfarm payrolls (excluding government jobs) jumped by 159,000, and September was revised upward to 107,000. With wages and hours worked also increasing, it looks like credit is already expanding. In fact, the $30 billion small business credit bill passed recently will also inject additional liquidity into small businesses.

Average hourly earnings gained 0.2 percent in October after rising 0.1 percent in September, while the average workweek for all workers edged up to 34.3 hours from 34.2 hours in October. The workweek has been on a rebound since mid-2009. Between the gains in temp workers and the average workweek, one should expect a pickup in hiring as these two series typically rise before overall employment.

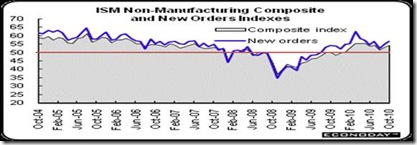

Service sector activity in October —which accounted for 154,000 of the 157,000 private payroll pickup—followed the manufacturing sector surge. So the bulk of the economy picked up steam in October, according to the ISM's non-manufacturing index which rose 1.1 points in October to 54.3. This survey of ISM members covers services, construction, mining, agriculture, and forestry.

And lastly, motor vehicles sales continued to surge, as all 3 Detroit automakers reported surging profits, with GM on track to pay back its government bailout with an upcoming IPO. Combined domestic and import nameplate autos and light trucks (includes minivans, vans, and SUVs) jumped 4.2 percent to an annualized pace of 12.3 million units. While still below the cash for clunkers recent peak of 14.2 million in August 2009, the October number represents nearly steady growth from the recession low.

Deficit hawks tend to forget that some inflation is necessary for an economy to grow. The Japanese deflationary experience is crucial to understanding this. That is why the Fed is still in effect easing credit conditions by adding to bank reserves. And why small businesses should be the biggest beneficiaries of QE2.

Harlan Green © 2010

No comments:

Post a Comment