What does it mean that pundits/economists are now saying the end of the recovery is in sight? Barron’s economist Gene Epstein maintains, “The Recovery from the Great Recession of 2008-09 is almost definitely over. Starting Jan. 2 the expansion will resume.”

The ‘recovery’ ends when Gross Domestic Product (GDP) reaches the peak before the recession began—in Q4 2007, says Epstein. Growth will have made up for the loss in output sustained during the Great Recession, in other words, and the economy can finally begin to expand into new territory.

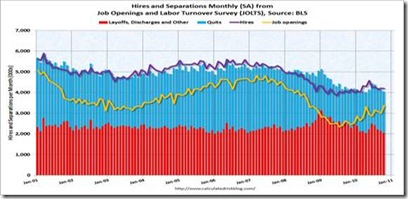

A look at the unemployment numbers tells us why. A survey from the U.S. Bureau of Labor Statistics—called the Job Openings and Labor Turnover Survey (JOLTS)—gives us the most accurate picture of the labor market. In October, about 4.047 million people lost (or left) their jobs, and 4.196 million were hired (this is the labor turnover in the economy) adding 149 thousand total jobs. Four million has been the historical monthly job turnover, so huge is our economy. So the jobless numbers relate to how many jobs are gained or lost above or below that number.

Also, total job openings increased from 3.0 million in September to 3.4 million in October, though overall labor turnover was still low. (The dark blue line (hires) is now above the light blue bars (quits + layoffs) with the yellow graph line of job openings steadily rising.

Economic growth reached its low point in Q2 2009, having fallen about 4.1 percent from its peak, the steepest loss since the Great Depression—hence this one being called the Great Recession. The latest (Q3) quarter probably expanded at 2.5 to 3 percent after all revisions, bringing growth back to its highpoint before the recession. Year-on-year, real GDP in Q3 is up 3.2 percent. Both Final Sales to domestic purchasers and Final Sales of domestic product (F.S.), a measure of overall demand, continued to increase.

Just as consumers take up almost 70 percent of GDP activity, retail sales are the most important component (50 percent) of consumer spending. And sales continue to rise for the fifth consecutive month. Overall retail sales on a year-ago basis in October was a huge 7.7 percent, slightly below 8.0 percent of the prior month.

Today's retail sales numbers should lead to upward revisions to forecasts for the Personal Consumption Expenditures component in fourth quarter GDP, says Econoday. Overall, sales are quite healthy overall despite price issues. (Since retail sales do not adjust for inflation, it is difficult to determine if ‘real’, after inflation sales are staying ahead of inflation.

A more esoteric measure of sustainable demand is the inventory-to-sales ratio that tells us how fast shoppers are emptying the shelves. Business inventories rose 0.7 percent in October in a light build given a very strong 1.4 percent rise in business sales. The mismatch pulled the inventory-to-sales ratio down one notch to 1.27. The comparatively small build is a plus for the economic outlook, pointing to the need to build inventories faster which requires output and employees, says Econoday.

The strong retail sales report for November points to the possibility of a further draw in November retail inventories. Based on government data, retailers appear to be having trouble keeping goods on store shelves.

What should not be hard to understand is that private businesses begin to hire only when they see sustainable demand for their goods and services increase, as we said last week. And because we have returned to pre-recession growth levels, that demand seems to be sustainable.

Harlan Green © 2010

No comments:

Post a Comment