Popular Economics Weekly

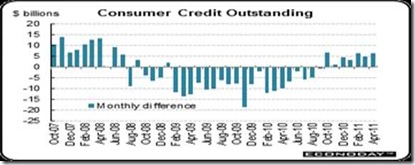

Maybe it’s Spring? Consumers must be feeling better, since they are able to pay down their debt load, while spending more. Personal consumption and even pending real estate sales are up in May-June, while mortgage delinquencies continue to fall.

Mortgage delinquency rates peaked at 10.97 percent in December 2009, and have been falling steadily since, though foreclosures have not been declining. That’s because lenders are every so slowly working through their backlog of seriously delinquent mortgages—those more than 6 months in arrears. Both delinquencies and foreclosure levels are still far above the historical rates of 4 percent and 1 percent of all mortgages, respectively.

According to Lenders Processing Services (LPS), 7.96 percent of mortgages were delinquent in May, down slightly from 7.97 percent in April. LPS also reports that 4.11 percent of mortgages were in the foreclosure process, down from 4.14 percent in April. This gives a total of 12.07 percent that are delinquent or in foreclosure.

The Pending Home Sales Index put out by the National Association of Realtors, a forward-looking indicator based on contract signings, rose 8.2 percent to 88.8 in May and is 13.4 percent higher than in May 2010. The data reflects contracts but not closings, which normally occur with a lag time of one or two months.

“Absorption of inventory is the key to price improvement, and this solid gain in contract signings implies that home values in many localities are or will soon be stabilizing as inventories get absorbed at a faster pace,” said NAR chief economist Lawrence Yun. “Some markets have made a rapid turnaround, going from soft activity to contract signings rising by more than 30 percent from a year ago, including areas such as Hartford, Conn.; Indianapolis; Minneapolis; Houston; and Seattle.”

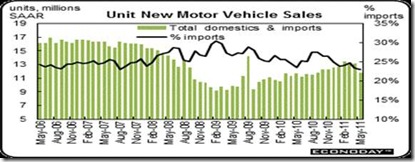

Consumers also continue to shop. Retail sales on a year-ago basis in May came in at 7.7 percent, compared to 7.3 percent the month before. Excluding motor vehicles, sales increased a huge 8.2 percent, up from 6.8 percent a year ago in April.

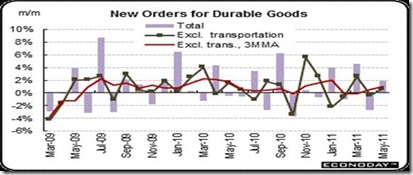

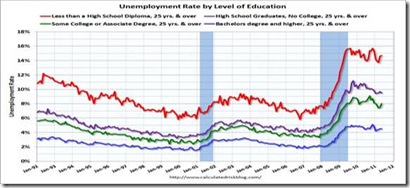

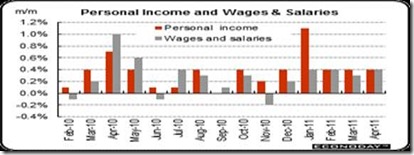

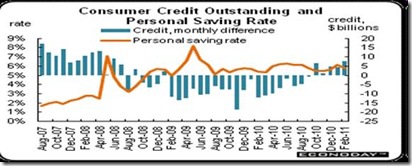

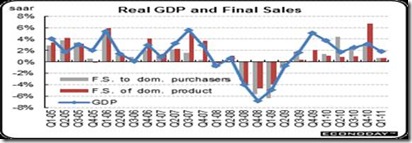

When will businesses begin to spend their cash hoard? Only when so-called effective demand picks up, and that won’t happen until more debt is paid down. All household debt including mortgages still totals more than 100 percent of household assets. That is why demand is still relatively weak across the board, whether for durable goods (that last more than 3 years), or services. This means incomes have to substantially increase as well.

The good news is that increases in durable goods orders for the latest month were broad-based by industry. Transportation led the way with a monthly 5.8 percent jump, following a 9.4 percent drop in April. The swing in both months was largely nondefense aircraft (Boeing) which surged 36.5 percent in May after a 29.0 percent fall the month before. Defense aircraft rebounded 5.5 percent after a 0.4 percent dip. However, the auto industry appears to still be suffering from supply shortages. Motor vehicles edged up only 0.6 percent, following a 5.3 percent fall in April.

Household net worth, the best measure of financial health, is also improving, as we said last week. It is at 370 percent, above the long term average of 350 percent, according to the Federal Reserve’s latest Flow of Funds report, while the personal savings rate is hovering around 5 percent, meaning that consumers are saving enough to continue to pay down their debts.

The Federal Reserve Bank of San Francisco also believes that corporations won’t open their pocketbooks until household debt levels decline further. “If the main problems facing businesses relate to depressed consumer demand due to a household sector weighed down by debt, investment tax subsidies and lower interest rates may have a limited effect on business investment and employment growth,” said a recent SFFRB report. “The evidence is more consistent with the view that problems related to household balance sheets and house prices are the primary culprits of the weak economic recovery.”

One would think higher corporate profits should mean corporations will eventually have to hire more workers, if they want to stimulate future demand for their products and services. Higher profits also mean a lower price-to-earnings ratio for stock values (earnings being the denominator in the P/E ratio), which has been hovering around 15:1 for the S&P 500 largest corporations of late. And a P/E ratio below 15:1 has historically boosted stock prices. So this new report should give a boost to stock prices for the rest of the year, but what will corporations do with the proceeds, other than using it for stock buybacks and cash bonuses to its executives? Creating more jobs is another story.

Harlan Green © 2011