Popular Economics Weekly

What was the reason for Fed Chairman Bernanke’s almost pathetic plea to understand real world economics, in his latest speech at the Atlanta IMF Conference? He said in essence that the Fed is caught between worries about inflation and an economy that is sputtering along. But in fact he was really calling for help!—that he needed help from Obama and Congress to keep economic growth going, because there is still a great danger of deflation than inflation.

If politicians want to obsess over the possibility of future inflation, in other words, then let them tackle the longer term entitlement problems—like Medicare, or foreign wars. But instead they are doing all the wrong things, as are the Europeans. They keep advocating drastic austerity measures while cutting taxes, when that will only depress growth further and expand the deficit (via less tax revenues), not shrink it.

Economic growth has slowed at the moment. But much of this is because of geopolitical uncertainty—the Arab Spring, Mideast oil, the euro bailouts of Greece, Portugal and Ireland, and maybe even our own debt ceiling problem.

But the Federal Reserve’s Beige Book report says most of the U.S. is still growing, retail sales are getting better, consumers and homeowners are paying down debt, and service sector activity in general that provides up to 70 percent of our growth is expanding faster.

Then why the obsession with inflation when it is just gasoline prices that are boosting the CPI index at the moment? Without gas prices the CPI has risen just 1.2 percent in a year. It is the classic battle between creditors and debtors that heats up during recessions. Creditors hate any inflation, since it devalues existing debt. And right now creditors—bankers and other holders of debt on Wall Street—seem to control the agenda. That is why we are hearing cries of austerity and budget cutting--all deflationary measures. Such policies drive down prices, all right, into deflationary spirals such as caused the Great Depression if done at the wrong time—like during this weak recovery.

The best weekly news was the jump in the Institute of Supply Management non-manufacturing (i.e., service-sector) index, which now makes up 70 percent of economic activity. The ISM reported broad month-to-month acceleration in the non-manufacturing economy. The report's composite headline index rose 1.8 points to 54.6 with strength centered where it should be, that is in new orders which rose more than four points to 56.8.

The ISM employment index also accelerated nicely, up 2.1 points to a 54.0 level that for this report is very strong. In other readings, deliveries lengthened, which is a sign of strength, and backlog orders rose at a healthy pace. Given that this report is based on a broad sampling of the nation's purchasers, says Econoday, it indicates that economic momentum is headed back up, albeit moderately.

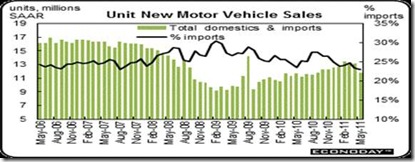

One reason for what looks like a temporary slowdown, is that sales of combined North American-made vehicles and imports dropped to an annualized 11.8 million units from 13.2 million in April. The North American component declined to 9.1 million from 10.1 million.

The North American component includes Japanese brands assembled in the U.S. and parts shortages limited supply of many models significantly. Lack of available Japanese brands pushed up related prices. This may have convinced many car buyers to wait for the desired model to become available and/or for a lower price, according to analysts.

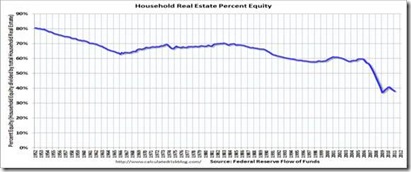

What is the help that Bernanke’s Fed needs? It can’t do all the heavy lifting, if more fiscal stimulus isn’t forthcoming. A good place to start is forgiving some of the $trillions in delinquent real estate debt incurred during the Great Recession. Real estate is hurting so much because it is estimated 25 percent of home loans are under water—i.e., have more loan than equity in their property. So the quickest way to bring down their debt load—which is holding back consumers spending—is to forgive some amount of the underwater mortgage principal, with some kind of loan modification.

The first quarter 2011 Federal Reserve so-called Flow of Funds report shows just how much is already “forgiven”, in some sense. Much of homeowners’ equity has been lost with so many foreclosures and short sales, of course. But homeowners are also paying down debt in record amounts.

The Fed estimated that the value of household real estate![]() fell $339 billion in Q1 to $16.1 trillion in Q1 2011, from just under $16.5 trillion in Q4 2010. The value of household real estate has fallen $6.6 trillion from the peak - and is still falling in 2011.

fell $339 billion in Q1 to $16.1 trillion in Q1 2011, from just under $16.5 trillion in Q4 2010. The value of household real estate has fallen $6.6 trillion from the peak - and is still falling in 2011.

In Q1 2011, household percent equity (of household real estate) declined to 38.1 percent as the value of real estate assets fell by $339 billion. A note by Calculated Risk says something less than one-third of households have no mortgage debt. So the approximately 50+ million households with mortgages have far less than 38.1 percent equity - and 10.9 million households have negative equity.

But banks are reluctant to modify loans unless urged by the White House, banking regulators, and/or Congress, even though it is also in their interest to take the delinquent mortgages off their books. And there has been no requirement that mortgage holders/servicers do so, even with the HAMP loan modification program.

Creditors—or rentiers in Europe—were also calling the tune at the beginning the Great Depression in the Hoover Administration. Roosevelt understood this, and instituted inflationary measures by increasing government spending, with regulations that controlled the banking speculation that caused the credit bubble—i.e., highly leveraged bank loans with no regard to risk. It took some inflation to get the economy growing again. In other words, it was the debtors turn to recover, which ultimately brought us out of the Great Depression.

The Roosevelt Administration actually refinanced more than 1 million homes under the Home Owners’ Loan Corporation from 1933-35, with bonds sold to the banks. It also bought many homes lost to foreclosure and rented them back, until they could be sold into the private market. Can we imagine what could be done today with that same political will? One million homeowners then would translate to at least 5 million today, when it is estimated there are no more than 8 million homes in various stages of delinquency. That is, if there is the political will to clean up the real estate mess.

Harlan Green © 2011

No comments:

Post a Comment