Popular Economics Weekly

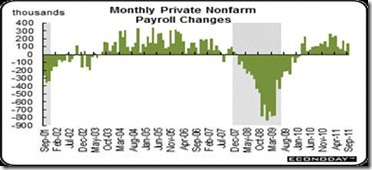

Friday’s Labor Dept. employment report was good for several reasons, but tight credit is holding back small business hiring, where most jobs are created. The loss of government jobs is also holding back substantial jobs’ growth, but prior months’ jobs creation was much better than forecast. Payroll jobs advanced 103,000 in September, following a revised 57,000 rise in August (originally flat) and revised 127,000 increase in July (previously 85,000).

And revisions to Labor’s JOLTS Report (Job Openings, Layoff and Turnover Survey) show that 3.228 million jobs were available in July, an increase of 275,000 job openings just since April, the low point of the current slowdown.

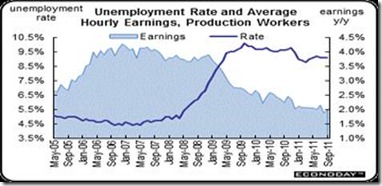

Another good sign was that wages rebounded 0.2 percent in September after dipping 0.2 percent the prior month. On a year-ago basis, average hourly earnings are up 1.9 percent, compared to 1.8 percent in August. The average workweek for all workers in September ticked up to 34.3 hours from 34.2 hours in August. Looking ahead, September’s numbers point to a healthy private wages & salaries component in the upcoming personal income report, says Econoday. Aggregate private weekly earnings jumped 0.6 percent in September.

So where are the jobs, and why all the corrections? Actual job creation has been rising much faster than reported, but the Bureau of Labor Statistics doesn’t always get it right when it subtracts so-called Seasonal Adjustments of up to 1 million jobs per months during summers when students tend to flood the jobs market. Hence the revisions in past months when state unemployment insurance claims are finally tallied. So this is a case where initial employment reports are always subject to revisions, whereas longer term averages are more accurate.

And though there are more than 14 million unemployed, the 3.2 million job openings in America are largely due to the rapidly changing need for skills. A recent CNBC article highlighted the misfit between job openings and skill shortages. Over the past few weeks a number of CEOs have appeared on CNBC and told the same story: they have job openings they can’t fill because they’re unable to find workers whose skills match the job.

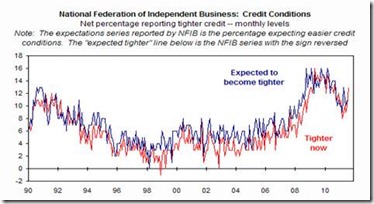

But that does beg the question. Companies can always train new workers to fill their job slots. The National Federation of Independent Business (NFIB) business conditions index (a small business survey) highlights a deeper reason for the so-called skill disparities. It is a lack of available credit that small businesses in particular need to expand, since small businesses provide most of the job creation in any recovery.

The NFIB’s business conditions index September increase wasn’t large (+0.8 points to 88.9), but was better than a seventh straight decline would have been, said Wrightson ICAP. In August, the net percentage of small business respondents reporting that credit was harder to obtain jumped three points to an 11-month high of 13 percent, and the percentage expecting credit conditions to deteriorate also rose.

The culprit? Our S&P debt downgrade and European debt problems have scared the debt markets so that little new debt is being issued, which all businesses need to expand. Per Wrightson ICAP: “In the wake of the debt ceiling default scare, the index for general economic expectations fell to -26 in August, versus a previous cyclical low of -23 in 2008. The September “recovery” brought it back only to -22.”

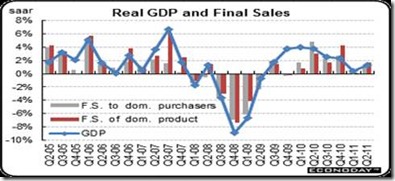

In another revision, economic growth for the second quarter actually did end up stronger than previously estimated but still anemic. The Commerce Department’s final estimate for second quarter GDP growth was bumped up to a rise of 1.3 percent annualized, compared to the prior estimate of 1.0 percent annualized and to first quarter growth of 0.4 percent. The anemic growth was due to declining incomes, which have been dropping since their high in January. This is what is being described as the ‘new normal’ for economic growth—i.e., not enough growth to keep up with population growth

There is also some recovery in real estate, as construction made a comeback in August, largely from the public sector although major private components also gained. Construction spending in August rebounded 1.4 percent in August, following a 1.4 percent drop in July, and is in positive growth territory for the first time in more than a year.

And both the service sector and manufacturing ISM surveys were looking better in September. Business activity in the service sector, that is production, rose 1.4 points to a 57.1 level that shows the strongest rate of monthly growth in six months. The manufacturing sector also continues to improve, with employment and production up, but orders in the manufacturing sector flat at the very best, according to September data from the Institute For Supply Management.

The bottom line? We must find more ways to ease credit conditions. Lenders are scared that Europe may default on its debts, and that the U.S. might suffer a further S&P downgrade, at least, if Congress can’t agree on a budget for the new fiscal year that began on September 1.

We can stimulate faster growth if we will all pull together, as Fed Chairman Bernanke so eloquently said in his latest congressional testimony: “Monetary policy can be a powerful tool, but it is not a panacea for the problems currently faced by the U.S. economy. Fostering healthy growth and job creation is a shared responsibility of all economic policymakers, in close cooperation with the private sector”.

Harlan Green © 2011

No comments:

Post a Comment