Popular Economics Weekly

What do we make of this year’s economy, with its ups and downs that have confused even the ‘experts’; and what to make of 2012? Believe it or not, the congressional gridlock that caused the S&P Treasury debt downgrade may actually boost growth. Because the Bush-era tax cuts are scheduled to expire end of 2012, which would put them back to the Clinton-era tax brackets. And we know what happened during Clinton’s Presidency—22.7 million jobs created, and 4 consecutive years of budget surpluses were paid for with the combination of higher income tax brackets and reduced government spending.

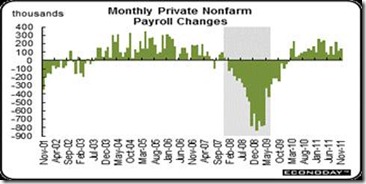

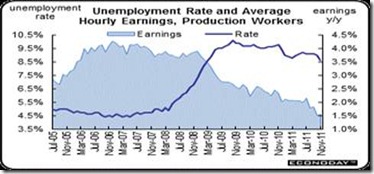

Firstly, we should understand that the experts overestimated economic growth at the beginning of 2011, then underestimated it by midyear—which means that we were never in danger of a second recession. The best example is our unemployment numbers. From June onward, both private payrolls and the self-employed have been increasing at more than 200,000 per month, which is close to pre-recession levels.

The household survey component of the jobs report including the self-employed – an actual headcount of working Americans – has shown a gain of 1.28 million over the past four months alone, whereas initial payroll formation showed zero or almost zero job growth in August-September before it was upgraded. And that—with the S&P credit downgrade and euro worries—is what set off new recession talk.

Payroll jobs in November advanced a relatively strong 120,000 after gaining a revised 100,000 in October (originally 80,000) and increased a revised 210,000 in September (previously 158,000). So look for upward revisions once again. Revisions for September and October were up net 72,000. Once again, private payrolls (less government layoffs) gained more than overall. Private nonfarm payrolls gained 140,000, following a 117,000 increase in October and 220,000 rise in September.

Then we had the so-called congressional Supercommittee not being super at all. They couldn’t agree on what budgets to cut, or revenues to raise. But as Paul Krugman has said, that may be a good thing—

“The supercommittee was a superdud — and we should be glad. Nonetheless, at some point we’ll have to rein in budget deficits. And when we do, here’s a thought: How about making increased revenue an important part of the deal?”

In fact, such a budget deficit during the worst recession since the Great Depression is necessary to fund vital public services and keep the economy running, until private business begins to invest again. And that won’t happen until consumer spending picks up, as we have said in past columns. The deficit will improve as the economy continues to grow, in other words, but won’t pick up if more jobs are cut—whether from the private or public sectors.

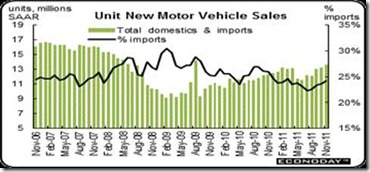

Consumer spending has barely held up during the various crises. It is best measured by consumer credit. Strength in consumer spending is confirmed by a build in outstanding consumer credit, up $7.6 billion in October following a revised $6.9 billion increase in September. The increase is once again centered in non-revolving credit, which reflects strength in vehicle sales. But a steady increase is now appearing for non-revolving credit, up $0.4 billion for a second consecutive month and offering evidence that consumers are once again, at least to a limited extent, using their credit cards.

That means it is real estate that is still holding up a stronger recovery. Despite headwinds, the latest pending home sales report indicates that housing may be back on a modest uptrend—at least for sales, according to Econoday. Low prices and low interest rates appear to be creating traction as the pending home index, which is a measure of contract signings for sales of existing homes, jumped 10.4 percent in October, following a 4.6 percent decline the prior month.

But the real measure of housing health is existing-home sales, which have been stuck in the 5million range since 2008, due to the large number of foreclosures and distressed sales.

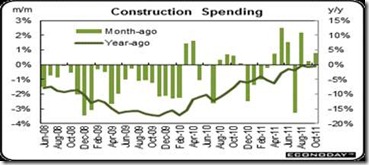

Housing prices are just now beginning to recover from a more than 30 percent plunge, as measured by the Case-Shiller Home Price Index. Housing construction is also showing some strength for the first time since 2009, which will add to GDP growth. Why? Household formation is picking up, as the so-called echo boomers—children of baby boomers—finally begin to leave their parents’ home. Household formation should double this year to 1 million from last year’s 500,000.

That is probably why construction spending in October advanced 0.8 percent after rising an unrevised 0.2 percent in September. The October increase was led by a 3.4 percent boost in private residential outlays, following a 0.6 percent rise in September. Construction outlays have risen three months in a row and in six of the last seven months. The level of activity is still subdued but it now appears to be growing and adding to overall economic growth, as we have said. It is not an “engine” like manufacturing but it is in better shape than even less than a year ago.

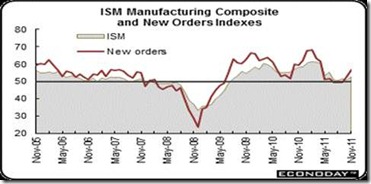

The latest report from the Institute for Supply Management also added to growth estimates as the manufacturing sector is regaining momentum. The ISM manufacturing index moved further into positive territory, rising 1.2 points in November to a reading of 52.7. The gain in the index was led by a 6.5 point jump in the production index to 56.6. Importantly, the new orders index was up a very strong 4.3 points to 56.7, above 50 to indicate monthly growth and pointing to continuing momentum.

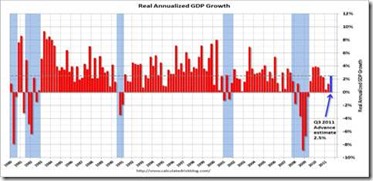

Lastly, Gross Domestic Product estimates, the best measure of overall growth, are being revised upward to 3 percent plus next year by economists, after the mid-year scare. So this also means more job creation if those forecasts are fulfilled.

Graph: Calculated Risk

The bottom line is that many difficulties lie ahead, but it doesn’t look like congressional gridlock can do much more to limit growth. In fact, if the Bush tax cuts of 2001, 2003, and 2006 were extended past 2012, it would increase the deficit by $3.7 trillion over the next decade, according to CNN. Whereas letting the cuts expire on December 31, 2012 would reduce the federal deficit by 40 percent over just the next five years.

So, if both progressives and conservatives would step out of their idelogical strait jackets, they would see that government doing nothing at the moment might be the best road to a recovery. One caveat—Wall Street can’t be allowed to again do business as usual. They are still lobbying ferociously to weaken regulation of derivatives’ trading under Dodd-Frank, which will also reveal just how much risk they are still taking with Other People’s Money—i.e., their investors. Until such reporting requirements are made law, over-the-counter derivatives’ trading, which totals some $600 trillion, according to the New York Times, will continue to endanger our overall economy.

Harlan Green © 2011

No comments:

Post a Comment