Popular Economics Weekly

There is a longer term fiscal crisis that current budget negotiators are ignoring. It is called the Tragedy of the Commons -- the long term neglect of common resources and facilities used by all, including our air, water, and public infrastructure, thus allowing them to deteriorate to conditions that require enormous sums to fix in the future.

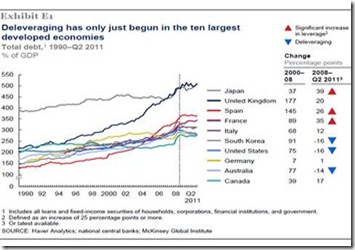

All of the 'fiscal cliff' discussions have centered on how to cut government spending on public programs or raise enough revenues to diminish the current deficit that was created by too much borrowing over the last decade -- to pay for two wars, the Bush tax cuts, and consequent Great Recession that diminished revenues further.

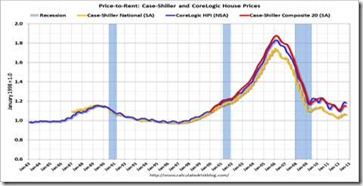

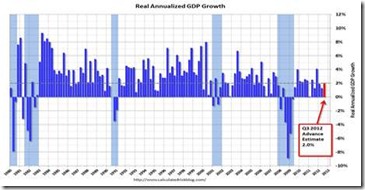

But in fact there would be a much smaller deficit if instead the negotiations included reversing the neglect of our public resources and services. That is where we can immediately gain back some of the approximately $6 trillion in output lost due to the Great Recession. Most economists agree that up to three million jobs were created or saved in 2009-10 just from the $830 billion ARRA spending enacted by President Obama when he took office.

How much more growth could we gain from fixing the $2.2 trillion in deferred maintenance on our highways and bridges -- the estimate by the American Society of Civil Engineers? The ASCE report, Failure to Act: The Economic Impact of Current Investment Trends in Surface Transportation Infrastructure, found the nation's deteriorating surface transportation infrastructure will cost the American economy more than 870,000 jobs, and suppress the growth of the country's Gross Domestic Product by $897 billion by 2020. Conducted by the Economic Development Research Group of Boston, the report shows that the nation is facing a funding gap of about $94 billion a year compared with our current spending levels.

Most economists know how to stimulate a greater demand for those 'lost' goods and services. Economists call it aggregate demand, demand that is powered by a combination of consumer plus government plus capital expenditures. And there is very little domestic capital investment at present. It is being hoarded by corporations, or invested overseas.

Study after study has shown that economic growth reduces deficits, rather than spending cuts, per se, as evidenced by Great Britain's conservative government focus on cutting government spending. Austerity has just increased their deficit, and put them in danger of losing their AAA rating, said the New York Times' Adam Davidson.

"The British economy, however, is profoundly stuck. Between fall 2007 and summer 2009, its unemployment rate jumped to 7.9 percent, from 5.2 percent. Yet in the three and a half years since -- even despite the stimulus provided by this summer's Olympic Games -- the number has hovered around 7.9. The overall level of economic activity, real GDP, is still below where it was five years ago, too. Historically, it's almost unimaginable for a major economy to be poorer than it was half a decade ago. (By comparison, the United States has a real GDP that is around a half-trillion dollars more than it was in 2007.)"

The term Tragedy of the Commons was coined by Garrett Hardin in a 1968 article. He said that problems that fall into this category have no technical solutions. They require changes in human attitudes and behavior, such as sustainable development of our common resources, rather than neglecting them. And that creates jobs that give more bang for the buck.

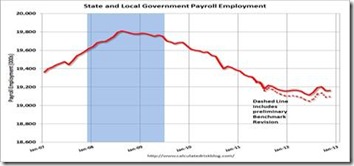

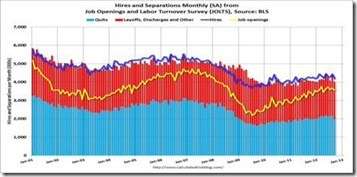

Three-fifths of all jobs lost during the Great Recession paid middle-income wages, while those created during the economic recovery pay low wages, according to a new study by the National Employment Law Project, largely because of the huge cutback in public and private investment. Both economic forces and government budget cuts are causing this deficit of good jobs, according to the study, as we have discussed in past articles.

We need for our congressional negotiators to correct this Tragedy of the Commons. The workers are there, already trained, in both the public and private sectors. Such investments can no longer be put off, or the fiscal cliff could become a bottomless pit that damages economic growth for decades to come.

Harlan Green © 2012

Follow Harlan Green on Twitter: www.twitter.com/HarlanGreen