Financial FAQs

Why so much surprise in January’s employment report that added 243,000 payroll jobs and dropped the unemployment rate to 8.3 percent? The U.S. has now added an average of 183,000 jobs a month in the past five months, while both the manufacturing and service sectors have been expanding for 30 months, since August 2009. You would think that would be grounds for some optimism this year, but it hasn’t cheered up many, including the Federal Reserve.

Economists and pundits, in particular, seem to have been blinded by everything from the euro’s demise, to slower growth in emerging countries, to an overheating of the Chinese economy had been used to tone down predictions for 2012 growth. Even the Fed’s forecasts have been downgraded, though Fed Chairman Bernanke did say the jobs market “had improved modestly” in his latest congressional testimony.

Graph: CBPP

Some of the surprise was due to a pickup in both residential and non-residential construction, as real estate seems to slowly recovering, in part because of extremely affordable housing prices. Construction employment has added 52,000 jobs over just the past 2 months.

A total of 257,000 jobs were added in the private sector minus 14,000 public sector job losses. And Marketwatch reported that employment rose by an incredible 631,000 in January in the Household survey (that includes the self-employed) after adjusting for the effects of updating the population count. That’s the biggest increase since late 2007. Over the past six months, employment as measured by the household survey has increased by 1.98 million, the biggest increase in more than six years.

But there’s more to the story. The steady stream of irrationally pessimistic stories has until now reinforced the belief that our institutions had failed—from government to financial markets, and the private sector business in general that laid off more than 8 million workers from 2008-10.

The bad news had been drowning out the good news, in other words, had reinforced the stories we all hear in the media and elsewhere that tended to emphasize the negative in any report, in spite of the now 2 years of steady job and overall expansion of economic growth since the June 2009 end of the Great Recession .

Graph: Calculated Risk

This is what Robert Shiller and George Akerlof discussed in Animal Spirits, How Human Psychology Drives the Economy and Why it Matters for Global Capitalism, which further develops famous economist John Maynard Keynes’ thesis that animal spirits, or emotions, drive most financial decisions. It was as much the negative news that permeated the air waves as anything that drove down consumer confidence to it record lows, in other words, and caused consumers and businesses to stop spending.

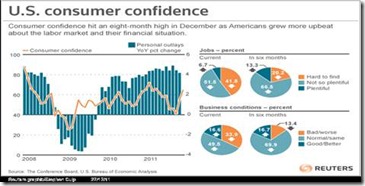

And we can measure the degree of confidence at any time in the economy, mainly via the two major confidence surveys of the Conference Board and University of Michigan. Confidence plunged to record lows in June, 2009 at the actual end of the recession, but are now returning to more normal levels.

Graph: Inside Debt

This was reinforced by faulty government statistics that said, for instance, there were no payroll jobs created last August—zip, zero—when in fact later revisions added 103,000 jobs in August, and additional jobs in later months.

Small business hiring has been part of the reason for increased employment, in part because of the Obama Administration’s freeing of $32 billion in SBA financing last year. And small business accounts for 70 percent of new jobs. Bank lending has increased 5 percent in the last half of 2011, according to NPR radio’s All Things Considered news program. In fact, stimulus spending over the past year may have contributed at least 1 percent to current growth, says the Center for Budget Priorities and Policies.

Also pushing growth has been large jumps in both manufacturing and service sector activity, via the ISM Purchasing Management surveys. A gigantic surge in employment and almost an equally dramatic surge in new orders headline a very strong ISM non-manufacturing report where the headline composite index jumped to 56.8, well beyond Econoday's consensus for 53.3 and a strong 3.6 points above December's upwardly revised 53.0.

Graph: Econoday

New orders jumped nearly 5 points to a 59.4 level that indicates strong monthly growth and points to acceleration in general activity in the months ahead. But the employment index is the eye catcher, up 8 points to 57.4 for by far the strongest reading of the recovery. This index has been lagging improvement in employment data from the government -- but not any more.

Graph: Econoday

Moderate and steady growth is the indication from the ISM manufacturing report where readings pretty much match those of December, said Econoday. The January composite index rose to 54.1, safely over 50 to indicate monthly expansion and 1 point over December to indicate a slightly faster rate of expansion (prior revised). A key highlight of the report is the new orders index which rose nearly 3 points to 57.6 to indicate a little bit more than just a moderate rate of monthly expansion. In another positive, backlog orders increased 4.5 points to show a build at 52.5.

Even builder confidence in the market for newly built, single-family homes continued to climb for a fourth consecutive month in January, rising four points to 25 on the latest NAHB/Wells Fargo Housing Market Index (HMI). This is the highest level the index has attained since June of 2007, and is why construction spending jumped 1.5 percent in December and has increased some 7 percent in one year.

"Builder confidence has now risen four months in a row, with the latest uptick being universally represented across every index component and region," noted Bob Nielsen, chairman of the National Association of Home Builders (NAHB). "This good news comes on the heels of several months of gains in single-family housing starts and sales, and is yet another indication of the gradual but steady improvement that is beginning to take hold in an increasing number of housing markets nationwide -- and that has been shown by our Improving Markets Index. Policymakers must now take every precaution to avoid derailing this nascent recovery."

So we don’t have to be pessimistic anymore. Rising confidence levels lifts all boats, as the saying goes.

Harlan Green © 2012

No comments:

Post a Comment