The Mortgage Corner

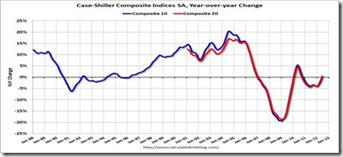

Home prices are finally rising nationally, according to same sales in the S&P Case-Shiller Home Price Index. It showed that all three headline composites ended the second quarter of 2012 with positive annual growth rates for the first time since the summer of 2010. The national composite was up 1.2 percent in the second quarter of 2012 versus the second quarter of 2011, and was up 6.9 percent versus the first quarter of 2012. The 10- and 20-City Composites posted respective annual returns of +0.1 percent and +0.5 percent in June 2012.

Graph: Calculated Risk

“Home prices gained in the second quarter,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “In this month’s report all three composites and all 20 cities improved both in June and through the entire second quarter of 2012. All 20 cities and both monthly Composites rose for the second consecutive month. It would have been a third consecutive month had we not seen home prices fall in Detroit back in April."

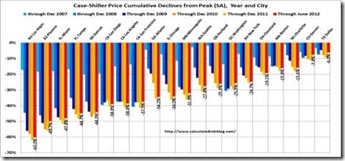

Graph: Calculated Risk

And the National Association of Realtors reported that the Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 2.4 percent to 101.7 in July from 99.3 in June and is 12.4 percent above July 2011 when it was 90.5. The data reflect contracts but not closings.

Lawrence Yun , NAR chief economist, said the index is at the highest level since April 2010, which was shortly before the closing deadline for the home buyer tax credit. "While the month-to-month movement has been uneven, more importantly we now have 15 consecutive months of year-over-year gains in contract activity," Yun said.

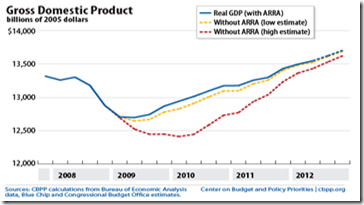

While not yet overwhelming, the real estate recovery will continue to spur growth, with construction spending also up some 7 percent in the year. But lower inventories are the key, and Realtors are reporting rising prices and multiple offers in most of the metropolitan areas.

Graph: Econoday

The FHFA house price index for homes financed with conforming mortgages extended a run of gains including a 0.7 percent rise for June. Year-on-year, the index is up 3.6 percent, which is slightly lower than May's upward revised 3.8 percent but otherwise well above prior months. Seven of the 9 regions posted gains in June led by a 3.5 percent rise in the Mountain region and followed by a 1.1 percent rise in the West North Central region. It showed very small changes in the West South Central and New England regions.

What can we say? That employment and personal incomes have increased enough, in combination with record low interest rates, to increase confidence that this economic malaise is finally coming to an end.

Harlan Green © 2012