The Mortgage Corner

Watch out, homebuyers! There may be few homes left on the market if the National Association of Realtors’ May Pending Home Sales Index is any predictor of future sales. This is even though mortgage rates have risen almost 1 percent in 3 weeks, as I said last week.

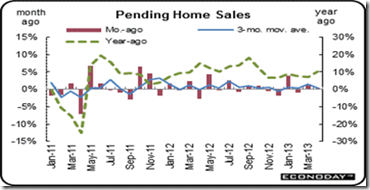

The pending home sales index surged 6.7 percent in May to its highest level since 2006. This has to be because of those rising mortgage rates as prospective buyers want to act before rates could move even higher. The index posted double-digit percentage increases in the Midwest and West. The index level of 112.3 is the highest since the boom days of 2006. The year-on-year gain for the index is 12.1 percent, which is interestingly right in line with double-digit gains for many home-price readings.

To the extent that the surge reflected fence sitters jumping into action, there might be some payback in future months, says Wrightson ICAP. “Also, the big increase could partly reflect seasonal adjustment difficulties, as this is the third consecutive year of May gains in the 5-to-7 percent range. Nevertheless, this is a strong report, and it suggests that existing home sales could rise to around 5.5 million in June, which would be the strongest showing since 2007.”

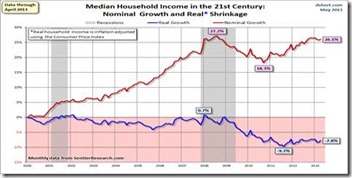

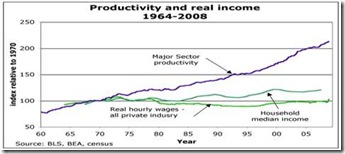

Another reason for the burst in pending home sales is the consumer sector made a comeback in May with income and spending improving. Personal income gained 0.5 percent after a 0.1 percent rise in April. Expectations were for a 0.2 percent increase. The wages & salaries component advanced 0.3 percent, following a 0.1 percent increase.

The latest inflation numbers contained in the PCE report confirm Fed officials concern that inflation is running too low. Year-on-year, PCE headline prices were up only 1.0 percent in May versus 0.7 percent in April, with the core was up just 1.1 percent. These numbers are well below the Fed's inflation target of 2.0 to 2.5 percent. And the savings rate increased to 3.5 percent, which means consumers are still holding on to much of their income, out of caution, no doubt.

It has to be why consumer confidence is in effect soaring. The Conference Board’s Director of Research Lynn Franco said why: “…Consumers are considerably more positive about current business and labor market conditions than they were at the beginning of the year. Expectations have also improved considerably over the past several months, suggesting that the pace of growth is unlikely to slow in the short-term, and may even moderately pick up.”

Expectations are also at a recovery best, up nearly 9 points to 89.5 and reflecting rising confidence in the long-term outlook for the jobs market. The outlook for income is likewise climbing with more now seeing an increase ahead vs. those seeing a decrease. This is an important indication that hints at gains for consumer spending including discretionary spending.

There could be a housing hiccup if mortgage rates continue to climb. But we don’t believe they will. There is no inflation, and interest rates did soften a bit this week after several Fed Governors, such as new Fed Governor Jerome Powell indicated the markets had overreacted.

“The reaction of the forward and futures markets for short-term rates appears out of keeping with my assessment of the [Federal Open Market] Committee’s intentions, given its forecasts,” Mr. Powell said. “To the extent the market is pricing in an increase in the federal funds rate in 2014, that implies a stronger economic performance than is forecast either by most FOMC participants or by private forecasters.”

The economy isn’t growing fast enough to cause the Fed to begin downsizing it QE3 program, in other words, particularly with the huge downward revision just reported of first quarter GDP growth to 1.8 percent from 2.4 percent.

Harlan Green © 2013

Follow Harlan Green on Twitter: www.twitter.com/HarlanGreen