The Mortgage Corner

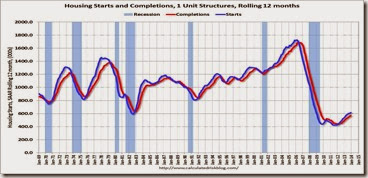

Residential investment and housing starts are usually the best leading indicator for economy, and they show continued growth. This isn’t the only leading indicator, but it suggests the economy will continue to grow over the next couple of years, says Calculated Risk. Housing starts increased 18.3 percent in 2013 (initial estimate). This was another solid year-over-year increase.

After increasing 28 percent in 2012 and 18 percent in 2013, the 923 thousand housing starts in 2013 were the sixth lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the three lowest years were 2008 through 2012). But Single Family starts have increased by one-third since the end of the Great Recession, as the supply of foreclosed homes and existing-home inventories have sharply declined.

Starts averaged 1.5 million per year from 1959 through 2000. Demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will probably increase another 50 percent + from the 2013 level, says Calculated Risk.

But there is a caveat to this scenario. Most economists are banking on new Fed Chairwoman Yellen to maintain QE3 at least through this year, while the ‘Taperians’ such as Governors Lacker and Fisher want to end it sooner, which would continue to boost mortgage rates, needless to say.

The latest mortgage origination figures support the slowdown in applications since rates have risen, according to the MBA’s weekly survey. Though there is a growing demand for new homes with inventories of existing homes on the market down to a 5.1 months’ supply, whereas inventories were as high as 8 months post-housing bubble.

Mortgage applications increased 11.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 10, 2014.

But it is down to its lowest level during the Great Recession. The MBA’s purchase applications index is also down for the year. This is mainly due to rise in mortgage rates of some 1 percent since April and former Fed Chairman Bernanke’s announcement that QE3 would begin to end sometime this year.

So it is not a given that real estate sales and prices will rise in 2014 as they have in 2013, when the S&P Case-Shiller Home Price Index rose some 13.6 percent. The key will be construction spending, which has been robust in 2013.

The U.S. Census Bureau just announced that privately-owned housing starts in December were at a seasonally adjusted annual rate of 999,000. This is 9.8 percent below

the revised November estimate of 1,107,000, but is 1.6 percent above the December 2012 rate of 983,000. Single-family housing starts in December were at a rate of 667,000; this is 7.0 percent below the revised November figure of 717,000. An estimated 923,400 housing units were started in 2013. This is 18.3 percent above the 2012 figure of 780,600.

Harlan Green © 2013

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment