The Mortgage Corner

Fannie Mae reported last week that the Single-Family Serious Delinquency rate declined in November to 2.44 percent from 2.48 percent in October. The serious delinquency rate is down from 3.30 percent in November 2012, and this is the lowest level since December 2008. This is when Fannie Mae serious delinquency rate peaked in February 2010 at 5.59 percent.

And Freddie Mac, the other GSE now administrated by the Federal Housing Finance Authority (FHFA), reported the Single-Family serious delinquency rate declined in November to 2.43 percent from 2.48 percent in October. Freddie's rate is down from 3.25 percent in November 2012, and is at the lowest level since March 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20 percent.

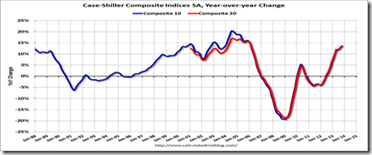

This tells us several things. Firstly, housing price continue to increase, with the Case-Shiller Home Price index now up 13.6 percent in 2013, so that homeowners now have more equity. Las Vegas and San Francisco had the largest prices increases in the 20 city index. And jobs are becoming more plentiful so that home owners are now able to sell or refinance their homes, rather than default on their mortgages. But the Fed will begin in January to cut back $10B per month in so-called Quantitative Easing securities’ purchases that has kept long term rates low since last September.

But the cutback in QE3 has S&P and banks worried about the future of housing in 2014. “Home prices increased again in October,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Both Composites’ annual returns have been in double-digit territory since March 2013. However, monthly numbers show we are living on borrowed time and the boom is fading.

“The key economic question facing housing is the Fed’s future course to scale back quantitative easing and how this will affect mortgage rates. Other housing data paint a mixed picture suggesting that we may be close to the peak gains in prices. However, other economic data point to somewhat faster growth in the new year. Most forecasts for home prices point to single digit growth in 2014.”

So relatively low interest rates will be a key to housing’s health in 2014, as well as whether the unemployment rate continues to decline. The prognostications so far are favorable, with unemployment projected to drop to 6.5 percent. And I believe interest rates will remain in the 4 percent range in 2014, since household incomes and therefore inflation, which reflects how much buying power consumers can maintain, will remain low.

Harlan Green © 2013

Follow Harlan Green on Twitter: www.twitter.com/HarlanGreen

No comments:

Post a Comment