Financial FAQs

A new report released by the World Economic Forum, ranks rising inequality as the top trend facing the globe in 2015, according to a survey of 1,767 global leaders from business, academia, government and non-profits, many of whom convened recently in Dubai.

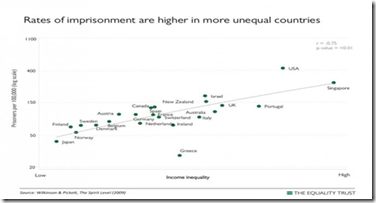

Its effects are barely known to economists, much less politicians. The U.S. has far and above the greatest income inequality in the developed world, as well as the highest crime and prison incarceration rates. Yet even economists such as Nobelist Paul Krugman can’t agree that this has had a measurable effect on economic growth!

Then what economic growth are we discussing when so many working age men (and women) are in prison, 2,300,000 at last count, the minimum wage is still $7.25 in most states, and we have had 5 recessions since 1980? Economists can’t be looking at the 90 percent of Americans that haven’t experienced any economic growth since 2009, and the recovery from the Great Recession.

The soaring inequality today matches that of 1928 before the Great Depression, and it is causing irreparable damage to our economy. Yet very little has been done about it, other than the American Recovery and Reinvestment Act’s $835 billion stimulus package of 2009 that saved or created some 3 million jobs according to the Congressional Budget Office, but whose effect petered out quickly in 2010 and reduced GDP growth to 2 percent until recently.

Economic growth has resumed with 321,000 nonfarm payroll jobs created in November, but 8 million jobs and at least $6 trillion in economic output were lost during the Great Recession, and . And with a Republican congress taking over in January, economic forecasters such as Macroeconomic Advisors are not optimistic about more job creating programs in the works due to a resumption of the budget battles soon to come, in spite of Republican protestations from new Senate Majority Leader Mitch McConnell that there will be no more government shutdowns.

Joel Prakken, a Macroeconomic Advisors co-founder, cited the effect further budget battles could have on growth in the New York Times. Past fights and the ensuing downgrade of U.S. government debt has cost approximately 1 percent in economic growth, which means instead of the 2.15 GDP growth average since Republicans took over the House in 2011, we could have had 3 percent plus growth and many more jobs.

How does inequality most affect growth? The classic answer is that since consumers power some 70 percent of economic activity, their spending power must be the driver of growth, and they cannot spend or save more with declining incomes, as the graph should make abundantly clear.

But it must be a quality of life issue, as well. How can we continue to live well in the most violent society in the developed world, with outmoded public infrastructure and educational facilities?

Richard Wilkinson and Kate Pickett’s The Spirit Level, a 30-year study of the effects of inequality, has said it best.

“Research has shown that greater inequality leads to shorter spells of economic expansion and more frequent and severe boom-and-bust cycles that make economies more vulnerable to crisis,” say Wilkinson and Pickett. “The International Monetary Fund suggests that reducing inequality and bolstering longer-term economic growth may be "two sides of the same coin". And development experts point out how inequality compromises poverty reduction.”

The consequences of growing inequality are too great to ignore. We now know from history what they are—two great economic downturns that can only be corrected with a return to the values that have made the U.S. great—economic justice for all.

Harlan Green © 2014

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment