The Mortgage Corner

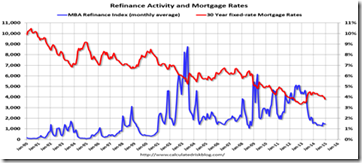

The still record-low interest rates are making a difference. Refinancings jumped 66 percent in January’s first two weeks, according to the MBA. And borrowers who refinanced during the fourth quarter of 2014 were able to reduce their interest rate, on average, by about 1.3 percentage points – a savings of about 23 percent, according to a recent Freddie Macs report. On a $200,000 loan that translates into saving of about $2,500 interest during the next 12 months.

Why? Conforming 30-yr fixed rates now are as low as 3.375 percent, and high-balance fixed rate conforming amounts can be found at 3.50 percent for 1 origination point.

"Our latest refinance report shows the refinance boom continued to wind down as the pool of potential borrowers declined over the course of 2014,” says Len Kiefer, Freddie Mac deputy chief economist. “However, because mortgage rates fell in the fourth quarter of last year, we actually saw the share of refinance originations tick up a bit despite volumes being down, a similar trend we expect to see for the first quarter of 2015 as mortgage rates have moved even lower.”

One popular program that in many cases doesn’t even require an appraisal for loan amounts up to 125 percent of value is the HARP II programs for conforming loans originated before June, 2009. Borrowers can reduce their interest rate to today’s market rates. But normal conforming qualification debt ratios and decent credit are required for HARP refinancings.

Home owners who refinanced through the government’s HARP program during the fourth quarter of 2014 saw an average reduction in their interest rate of 1.6 percentage points, according to Freddie Mac, amounting to an average savings of $3,300 in interest during the first 12 months – or about $275 in savings every month.

About 71 percent of those who refinanced their first-lien mortgage maintained about the same loan amount or lowered their principal balance by paying additional money at closing, according to the report.

But 34 percent of refinancers were able to shorten their loan terms, according to the report. This is when the conforming 15-yr fixed rate today is 2.50 percent. Overall, borrowers who refinanced in 2014 saved about $5 billion in interest over the next 12 months.

This has to spur home construction as well, since it enables the reduction of so much debt.

And sure enough, the U.S. Census Bureau of the Department of Commerce said that construction spending during October 2014 was estimated at a seasonally adjusted annual rate of $971.0 billion, 1.1 percent above the revised September estimate of $960.3 billion.

The latest NAR survey also showed more optimism for 2015 housing sales. An improving job market, low mortgage rates, and recent moves by the government to loosen up mortgage credit is fueling increased optimism among REALTORS®. In particular, real estate professionals are growing more confident about the housing market’s outlook for the next six months, according to the December 2014 REALTORS® Confidence Index, a survey of more than 4,000 Realtors.

So stay tuned, as winter wanes and interest rates stay low. Of course it will be up to the Federal Reserve as well, to maintain low interest rates for the rest of 2015.

Harlan Green © 2015

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment