Financial FAQs

The stock market plunged on news total nonfarm payroll employment increased by 295,000 in February, and the unemployment rate edged down to 5.5 percent, the U.S. Bureau of Labor Statistics reported today.

Why did stocks plunge on the BLS release when it was an extremely strong report with all sectors adding jobs? Because the financial markets mistakenly believe it will push up the Fed’s schedule for raising interest rates, and higher rates mean less excess liquidity to invest in the stock market.

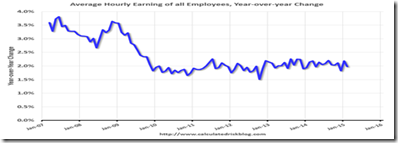

But Janet Yellen’s Fed isn’t focused solely on the rate of job formation or jobless rate, as she has said countless times, if the U.S. isn’t closer to full employment. And there wasn’t good news on wage growth; though January’s report had showed a slight improvement. The BLS report said: "In February, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $24.78. Over the year, average hourly earnings have risen by 2.0 percent."

This is the real reason the U.S. economy has taken so long to recover. There are still more workers out of work, or looking for work than available jobs that pay a living wage. And the unemployment rate shrank from 5.7 to 5.5 percent only because 178,000 left the workforce, because they stopped looking for work.

Why no wage growth after adjustment for inflation (now slightly under 2 percent)? A Federal Reserve study reported that the greatest demand for workers since the Great Recession has been in the poverty-level, minimum wage-paying service industries, and the lowest demand is for midlevel workers who once comprised the vast majority of the middle class.

A April 2014 report by the National Employment Law Project provided details supporting the Federal Reserve study. During the recession, low-wage jobs, those paying less than $27,700 per year, had both the lowest percentage of losses and the highest percentage of gains. Twenty-two percent of the total job losses were in the low-wage category, but 44 percent of new jobs were in that category.

Mid-wage jobs, those paying between $27,700 and $41,600 (i.e., middle class jobs), had the lowest percentage of new jobs created, 26 percent, but the second highest rate of job losses, 37 percent. High-wage jobs, those paying more than $41,600, had the highest rate of losses, 41 percent, but a higher rate of new jobs created, 30 percent, than the mid-wage category.

So Janet Yellen may not even be ready to raise interest rates in June, or sooner, as the financial markets fear. There can be no sustainable recovery, the Fed’s stated goal, until there is enough income growth to prevent another fallback into recession as happened to the Japanese and Eurozone economies because of premature credit tightening.

Harlan Green © 2015

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment