The Mortgage Corner

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 6.1 percent to a seasonally adjusted annual rate of 5.19 million in March from 4.89 million in February—the highest annual rate since September 2013 (also 5.19 million), said the National Association of Realtors report.

Sales have increased year-over-year for six consecutive months and are now 10.4 percent above a year ago, the highest annual increase since August 2013 (10.7 percent). This seems to corroborate yesterday’s Fannie Mae’s Economic & Strategic Research Group report that said economic activity was suppressed in the first quarter due largely to the West Coast port disruptions and difficult weather patterns across the Northeast, “but the economy is expected to gain momentum throughout the spring and reach previously anticipated levels by year-end.”

Total housing inventory at the end of March climbed 5.3 percent to 2.00 million existing homes available for sale, and is now 2.0 percent above a year ago (1.96 million). Unsold inventory is at a 4.6-month supply at the current sales pace, much too low for sustainable sales.

NAR Chief economist Lawrence Yun said, "The modest rise in housing supply at the end of the month despite the strong growth in sales is a welcoming sign. (But) For sales to build upon their current pace, homeowners will increasingly need to be confident in their ability to sell their home while having enough time and choices to upgrade or downsize. More listings and new home construction are still needed to tame price growth and provide more opportunity for first-time buyers to enter the market."

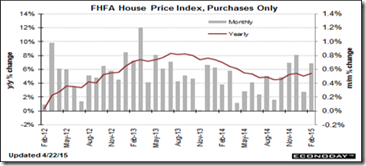

Prices are still rising, in other words, because of the lack of inventory. The FHFA just reported homes being purchased with conforming loans saw prices rise 5.4 percent in March. This is while new-home construction is still below par, with March starts up just 926,000, vs. the 1 to 1.2 million starts needed to increase inventories, and 2 million units annual rate at the height of the housing bubble.

An even better indicator of future housing growth was the Mortgage Bankers Association weekly activity report. The Refinance Index increased 1 percent from the previous week, reports Calculated Risk. The seasonally adjusted Purchase Index increased 5 percent from one week earlier to its highest level since June 2013. The unadjusted Purchase Index increased 6 percent compared with the previous week and was 16 percent higher than the same week one year ago.

“Purchase applications increased for the fourth time in five weeks as we proceed further into the spring home buying season. Despite mortgage rates below four percent, refinance activity increased less than one percent from the previous week,” said Mike Fratantoni, MBA’s Chief Economist.

All of the above is significant evidence that the buying season should pick up after winter doldrums, as it has in past years. How much remains to be seen. Consumers also have to come out of their winter doldrums.

Harlan Green © 2015

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment